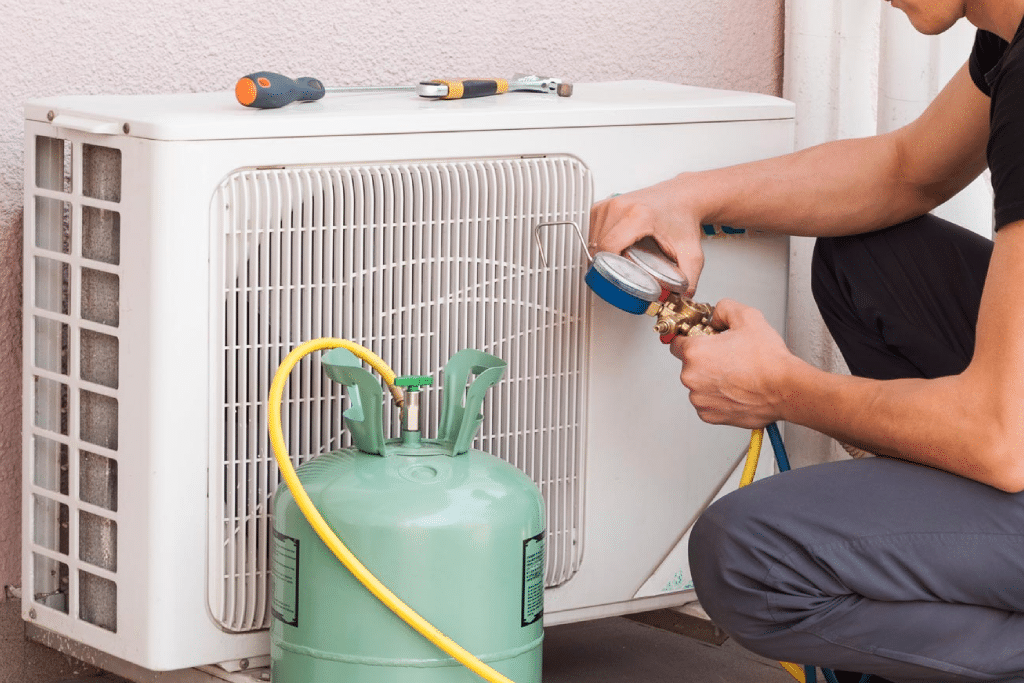

Air Conditioning Installation

Domestic Air Conditioning

Commercial Air Conditioning

Our Clients

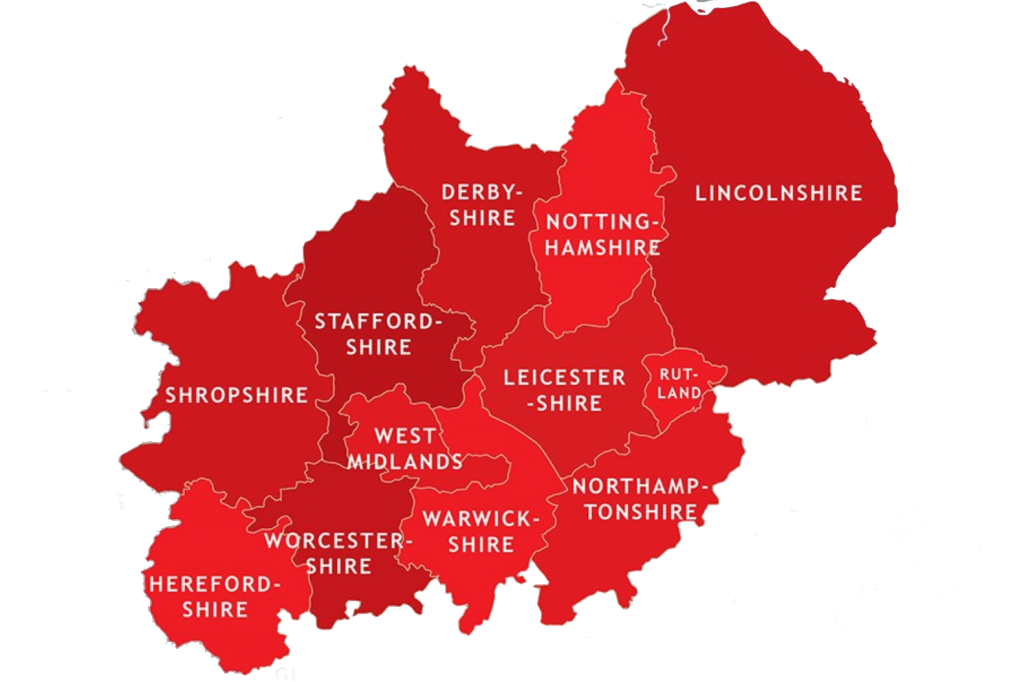

The benefits of an Air Conditioning Installation in the Midlands

With the the number of heatwaves in the UK steadily increasing and winters as cold as ever, having full climate control in your home or workspace makes all the difference not just for your quality of life, but the cost of utilities too.

Enhanced air quality including humidity control

Increased security with the added benefit of reduced noise pollution

During the height of summer, most UK buildings will opt to open windows and doors in an effort to combat the heat, which always presents a security hazard, especially for households at night.

As air conditioning operates at its best with windows and doors closed, you can maintain indoor temperature levels with a reduced risk to security and better still, remove the need for noisy fans which only circulate the same warm air and provide little to no cooling effects when faced with high temperatures.

Improved quality of sleep at home with added health benefits

Air Conditioning Installations - What type of air conditioning system can you expect?

Air Conditioning Installation Services in Your Area

- Air Conditioning Installation

- Air Conditioning Installation Birmingham

- Air Conditioning Installation Bromsgrove

- Air Conditioning Installation Leicester

- Air Conditioning Installation Coventry

- Air Conditioning Installation Stratford Upon Avon

- Air Conditioning Installation Sutton Coldfield

- Air Conditioning Installation Solihull

- Air Conditioning Installation Nottingham

- Air Conditioning Installation Warwick

- Air Conditioning Installation Wolverhampton

- Air Conditioning Installation Hinckley

- Air Conditioning Installation Kidderminster

- Air Conditioning Installation Lichfield

- Air Conditioning Installation Loughborough

- Air Conditioning Installation Burton Upon Trent

- Air Conditioning Installation Dudley

- Air Conditioning Installation Nuneaton

- Air Conditioning Installation Redditch

- Air Conditioning Installation Rugby

- Air Conditioning Installation Shrewsbury

- Air Conditioning Installation Stafford

- Air Conditioning Installation Tamworth

- Air Conditioning Installation Halesowen

- Air Conditioning Installation Cannock

- Air Conditioning Installation Telford

- Air Conditioning Installation Walsall

- Air Conditioning Installation West Bromwich

- Air Conditioning Installation Marston Green

- Air Conditioning Installation Coleshill

Domestic Air Conditioning system installations - Wall mounted and floor mounted systems

Choosing between Mitsubishi, Daikin and Toshiba

Not to forget Toshiba, with their range of air conditioning available in the UK since the 1960s, their unique innovations on electronics have seen them at the forefront of many of the new ac developments we see today. With all this in mind, MAC have their Seiya model actively available for installations as a direct alternative to the Mitsubishi HR, pairing simplicity with high efficiency with easy function control.

Climate Control Solutions for Your Business, wall mounts, ducted and more

The Best Solutions from Mitsubishi Heavy Industries

If wall space is limited or ceiling-mounted units are your preference, the FTD ceiling cassette may be a better option as its compact design and individual louvre control offer greater airflow control and its compact design is perfect for shallow ceiling voids. If a ceiling suspended unit is more to your liking, the FDE is a versatile option with multiple pipework positioning options, narrow visible height and extendable pipe runs for larger buildings that can reach up to 100 meters!

It's worth considering Air Conditioning Servicing and the Maintenance Too

You may not need a new Air Conditioning System if your existing units can be repaired

What Our Customers Say

Expert Midlands Air Conditioning Installation: Call MAC, Your Local AC Specialists!

Related Articles

- Air Conditioning Systems For Homes: 5 Key Benefits

- The Benefits of Air Conditioning

- Eco-Friendly Air Conditioning

- Domestic Customers Pay 0% VAT With MAC

- Choosing the Perfect Air Conditioning System for You

- What Is the Difference Between Split & Multi-Split Air Conditioning Systems

- Air Conditioning Unit Installation: How Long Does It Take to Install

- Do You Need Planning Permission for Air Conditioning Installation